The “Hydrogen Patents for a Clean Energy Future” report, released jointly by the European Patent Office (EPO) and the International Energy Agency (IEA), provides a comprehensive analysis of clean-energy hydrogen technology innovation over the past two decades based on global patent filings. As patents are a strong indicator of innovation activity and the state of science, the report offers valuable insights into the focus and direction of green hydrogen investment based on international patent families (IPFs). IPFs are considered a reliable proxy for inventive activity as they represent inventions that have sufficient value to seek protection across multiple patent offices. By examining the trends in IPFs related to hydrogen technologies, the report provides a unique perspective on the evolution of green hydrogen innovation and the potential for further development in this critical area.

US Losing Ground

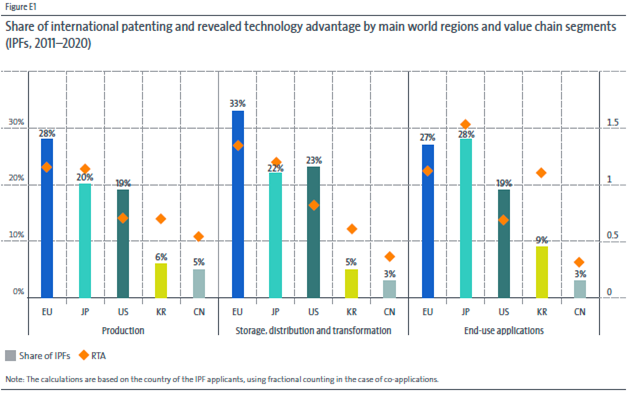

According the report, Europe and Japan are leading the world in hydrogen patenting, with the US losing ground in the period between 2011 and 2020. Half of the IPFs were related to hydrogen production, while the other IPFs were related to end-use applications, storage, distribution, and transformation of hydrogen. Europe has the largest number of IPFs in hydrogen patenting with 28%, while Japan follows with 24% of all IPFs published. Although the US contributed 20% of all IPF publications related to hydrogen, it is the only major region where the number of IPFs decreased during the past decade.

Innovation in Established and Emerging Hydrogen Technologies

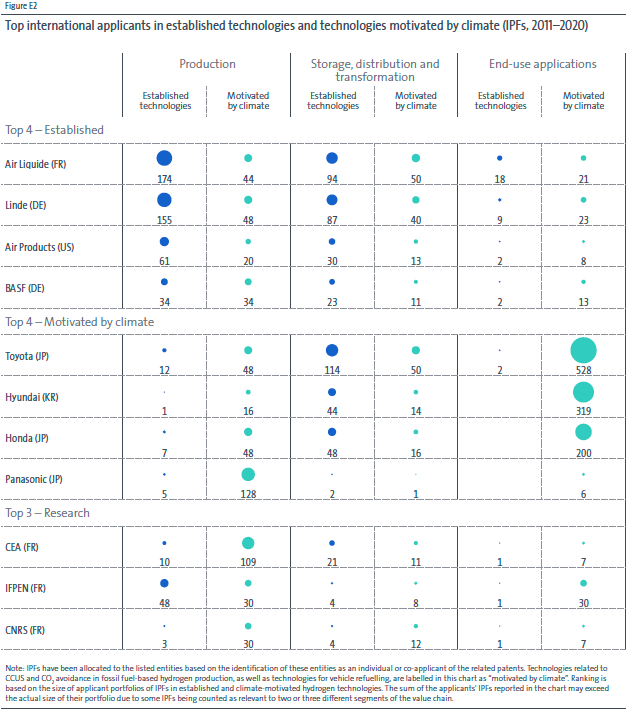

The European chemical industry dominates innovation in established hydrogen technologies, while companies in the automotive and chemical sectors are emerging as new heavyweights in electrolysis and fuel cell technologies. While established technologies continue to generate the majority of IPFs in hydrogen storage, distribution, and transformation, emerging technologies primarily motivated by climate change generated twice as many IPFs between 2011 and 2020. Top applicants in established technologies are chemical companies, whereas those in emerging technologies are led by Japanese and Korean companies, mainly from the automotive industry, with a focus on production by electrolysis and applications based on fuel cells. Universities and public research institutions generated 13% of all hydrogen-related IPFs between 2011 and 2020, with a strong focus on climate-motivated hydrogen production methods, such as electrolysis.

Shifting Patenting Trends in Hydrogen Production Technologies

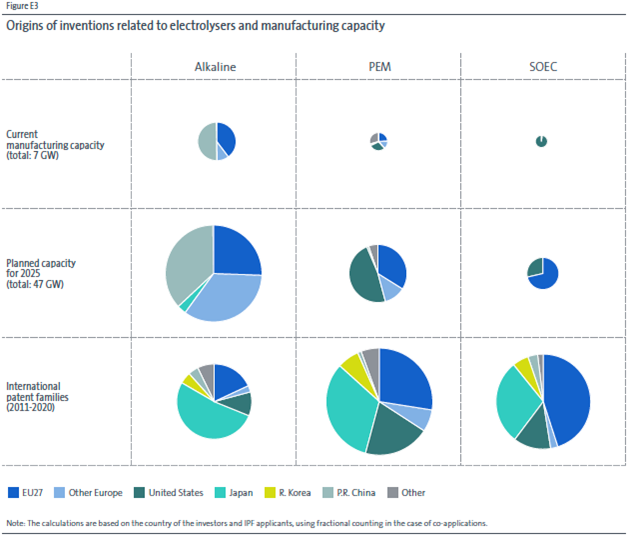

The report notes a clear shift from traditional, carbon-intensive hydrogen production methods to alternative low-emission methods, with technologies motivated by climate concerns generating nearly 80% of IPFs related to hydrogen production in 2020. A rise in innovation in electrolysis, specifically several categories of electrolysers, indicates a large expected market for electrolysers by 2030. The EU and other European countries are active in both patenting and manufacturing, with a particular edge in new manufacturing capacity for electrolysers. Meanwhile, published IPFs related to hydrogen production from fossil fuels have been decreasing since 2007.

Innovation in Hydrogen Storage and Distribution Technologies

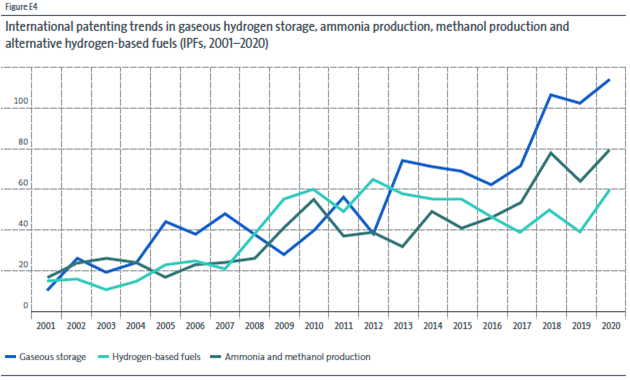

Patenting activities in hydrogen storage and distribution technologies have grown steadily since 2001, with a focus on improving established methods of hydrogen transportation. Automotive companies have become important patent applicants due to the significance of on-board hydrogen storage for the commercialization of hydrogen-powered vehicles. Patenting related to the use of hydrogen for ammonia and methanol production has also increased, with a focus on reducing the climate impact of their production processes. However, innovation in the development of hydrogen-based fuels, such as synthetic kerosene and methane, has lost momentum since 2011.

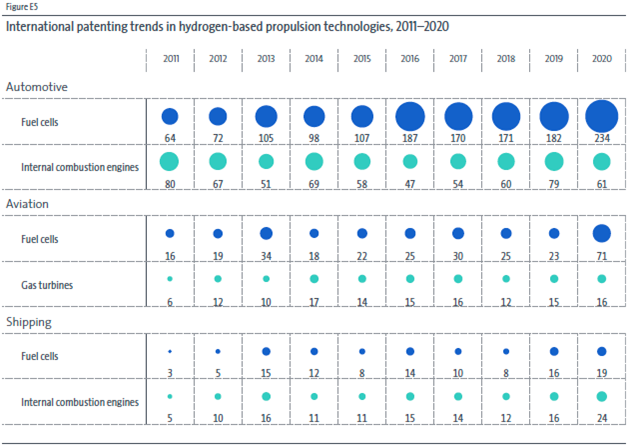

Hydrogen Innovation in the Automotive Sector Outpaces Other Industries, While Steel Production Patenting Sees a Rebound

Innovation in the automotive sector for hydrogen use continues to dominate, particularly in fuel cell propulsion, with Japanese and Korean automotive companies leading patenting activities. However, innovation has been slower to take off in other industrial applications, such as long-distance transportation using hydrogen-based fuels, including internal combustion engines and turbines. Steel production has seen a rebound in patenting activity, with nearly 40% of patenting activities between 2011-2020 concentrated among a small number of steel producers and equipment suppliers.

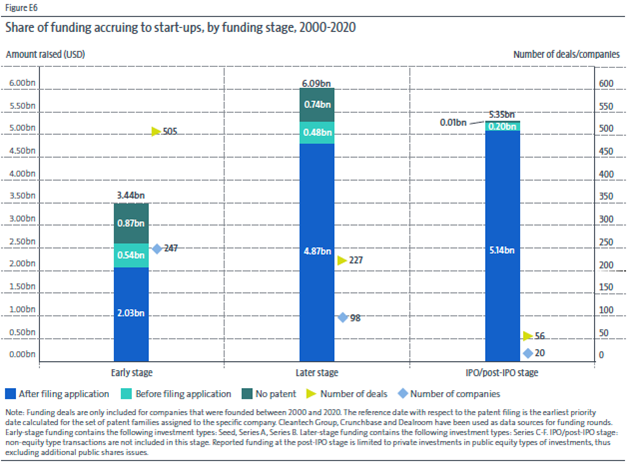

Importance of Patenting to Startup Fundraising

Patenting is crucial for start-ups developing hydrogen businesses as it underpins fundraising, with more than 80% of later-stage investment in hydrogen start-ups going to companies that had already filed a patent application. Almost 70% of the 391 hydrogen-related start-ups hold at least one patent application, indicating the importance of patenting for young firms in this area. The majority of hydrogen start-ups start their journey in the laboratory and rely on patents to secure their investments in R&D and engineering. Furthermore, the IPFs of hydrogen start-ups primarily target technologies motivated by climate, such as electrolysis and fuel cells.

Conclusion

The latest joint report from the EPO and IEA provides a comprehensive analysis of clean-energy hydrogen technology innovation over the past two decades based on global patent filings. The report highlights Europe and Japan as leading the world in hydrogen patenting, with the US losing ground. It also notes shifting trends in hydrogen production technologies, with a clear shift towards alternative, low-emission methods motivated by climate concerns. Innovation in the automotive sector for hydrogen use outpaces other industries, and patenting activities in hydrogen storage and distribution technologies have grown steadily. The report underscores the importance of patenting for startups developing hydrogen businesses, with more than 80% of later-stage investment going to companies that had already filed a patent application. For more detailed information and key findings, readers are encouraged to consult the full report.